A crypto license in Estonia is one of the most sought-after permits for financiers who want to work with E-holdings and develop innovative mercantiles in Europe. Over the past few years, this Baltic polity has demonstrated a systematic approach to the legal directive of blockchain techs, providing firms with the opportunity to relatively quickly and transparently open a crypto business in Estonia. Many have been considering this option since 2017, as local government institutions were at the forefront of digital innovation, and the supervisory setup was developed in such a way as to adapt to new trends in the field of virtual money. However, after 2022, the situation changed dramatically - regulators revised their approach to supervising E-money organizations, tightened needs, and began to monitor the actual presence of firms in the polity in more detail. In this regard, the question "How to get a crypto license in Estonia" in 2026 no longer looks so simple and requires a deep understanding of the alterations in the legal field.

In this article, we will look at the stages and nuances associated with obtaining a permit to function with electronic holdings in this region. The reader will receive detailed information about why, despite stricter needs, this polity remains attractive, what alterations have been made to the legislation, what the typical application procedure looks like, and what pecuniary aspects should be taken into account. We will also compare the polity with alternative regions that can offer their own advantages, and formulate recommendations for launching an E-money mercantile in terms of abidance with legal directives and cost optimization. Finally, a brief summary will be provided and it will be indicated how professional consultants can help with the sequence.

Why Estonia remains an important hub for crypto trade

The electronic money industry is developing rapidly, and many regions are trying to create a legal framework that can assert visibility without alienating investors. The Baltic region has proven itself to be quite flexible in this regard, and since the mid-2010s, it has been the Republic of Estonia that has become a leader in regulating innovative pecuniary instruments. However, not everyone knows how this polity has become such an attractive place to register an E-money startup and why transnational financiers are still considering it despite serious reforms.

In early 2017, the region known for its high-tech infrastructure and advanced e-government became the first in the EU to introduce licensing needs for firms working with virtual coins. Under the auspices of the local Financial Intelligence Unit (FIU), a mechanism was launched under which any organization planning to function in the field of bitcoin exchange or provision of E-money storage aids could apply for a crypto firm warrant in the polity, subject to a number of formal conditions. This step became a signal for thousands of firms from all over the world who wanted to legalize their schemes and enter the European market without cumbersome bureaucratic red tape. From 2017 to 2022, the number of permits issued exceeded two thousand, which became a record figure in the EU.

The success of the first wave of licensing was due not only to the liberality of the directives, but also to the general course of the Republic of Estonia towards digitalization. IT solutions have historically been implemented here, accelerating all sequences: from company enrollment to filing reports via electronic setups. However, following rapid growth, it became obvious that such loyalty attracts unscrupulous players. As the popularity of electronic money grew, firms entered the polity that sought to use Estonian legislation to circumvent stricter transnational AML needs. As a result, cases of abuse arose, which led to pressure from European institutions and forced the authorities to introduce fundamental alterations in the supervision of the sector.

Despite the tightening of measures associated with increased verification of the real presence of mercantiles and more thorough abidance control, investors continue to consider the possibility of enrolling a crypto trade in the polity. In 2023-2024, the government and relevant supervisory authorities actively adapted domestic legislation to European norms, including preparing for the entry into force of pan-European acts, including MiCA (EU Regulation 2023/1114). Today, trading in this Baltic polity is not as easy as a few years ago, but significant advantages have remained: the presence of an English-speaking mercantile environment, a clear reporting structure, a fairly transparent levy setup and a high degree of trust in the local legal order. As a result, if a firm has real plans to develop projects in the field of E-holdings, and not use a crypto warrant in the polity just as a signboard, then it is the local legislation that can become a solid foundation for entering European markets.

From a geographical point of view, Tallinn is interesting due to its proximity to the main pecuniary centers of Scandinavia and the EU as a whole. Remote operations can be easily organized here, cooperation with European banks can be established, and transnational transfers can be resolved. The main condition is a real presence, which consists of having a physical office and hiring local specialists involved in the firm's operations. Although this rule has become stricter, it has increased the reputational stability of this market. From the point of view of financiers, actual placement in the Baltic polity can also bring benefits in the area of partnerships: developers, IT experts, and legal consultants specializing in blockchain techs successfully function in the polity. Thus, the combination of the highest level of digital culture, reformed and transparent legislation, and the state's readiness for innovation answer the question of why VASP licensing in Estonia is still relevant.

Due to the colossal outflow of unscrupulous organizations, the number of holders of valid permits has sharply decreased to several dozen. According to official sources, by September 2024 there were about 45 of them left. However, these firms that survived on the market are often real providers of quality aids that value their mercantile reputation. As a result, this creates healthier competition and greater reliability for end users. Now, obtaining the appropriate status is not so much a formal procedure as a serious check of the corporate setup, the proper level of capital and a systematic approach to abidance. Below, we will look at specific alterations in the legislation to show how much more complex the needs have become for firms wishing to obtain a crypto license in Estonia to conduct legal schemes within the EU.

Alterations in regulation

In the previous section, we touched on the historical aspect of the development of the Ethe polity’s e-holding market and mentioned the transition from liberal directives to stricter supervision. Now it is time to look at the legal alterations that came into force in 2024 and will continue in 2026. For a long time, the main institution regulating the E-money sector was the polity's FIU. However, in light of the new legislative amendments, warrants have come under the control of the Estonian Financial Supervision and Regulatory Authority (EFSRA). This step is related to the increased attention to abidance with AML practices and the need to monitor a wide range of pecuniary instruments at a higher level.

An important part of the sequence was the adoption of the Crypto Markets Act (CMA) and the gradual integration of the pan-European MiCA directive. Although this area had been under the supervision of national authorities for several years, it was 2024 that brought a sharp increase in capital needs, management qualifications, and local presence. At the same time, the state realized that the e-money sector is not constrained to Bitcoin exchanges. Various tokens, including both classic coins and stablecoins, as well as more complex hybrid instruments, began to fall under the definition of crypto holdings. These innovations form a new status for crypto mercantile and affect those who want to establish a crypto company in Estonia with an eye on long-term work within the licit framework of the EU.

A significant change is the transfer of prime licensing functions from the FIU to the EFSRA. While previously supervision was carried out by the FIU, focusing primarily on the threats of money laundering, now crypto regulation in Estonia undergoes a more extensive evaluation. The EFSRA analyzes the applicant's mercantile model, checks pecuniary and operational threats, and oversees abidance with transnational norms for the safe conduct of schemes in the field of digital tokens. This significantly complicates the sequence of obtaining permission, since each application is considered via the prism of the pecuniary stability and professional training of the beneficiaries.

The supervisory act sets out criteria for classifying certain virtual instruments as distinct forms of pecuniary aids. At the same time, the MiCA regulation (2023/1114) comes into force, which is designed to unify the rules in all EU regions. However, MiCA comes into force in 2026, which gives firms time to adapt. Many analysts believe that the CMA has become the first step towards harmonizing local law with pan-European law, so those who intend to obtain a crypto license in Estonia need to fully conform with all needs in order to avoid problems with re-enrollment of their status.

It is important to understand that there is no longer a simplified path. If previously licit entities could relatively easily open a company and provide a minimum package of indentures, now regulators require evidence of real presence in the polity: from a physical office to qualified personnel capable of conducting operational schemes. At the same time, crypto warrant procurement sequence in the current conditions is no longer just a matter of filling out forms and paying a fee, but an entire project, including the development of internal KYC/AML policies, a detailed mercantile plan, peril strategy and confirmation of licit sources of capital. In addition, an obligation is created for the applicant to regularly report on their pecuniary deals, cooperating with the regulator and providing all the mandatory data upon request. This level of visibility, on the one hand, complicates life for firms, and on the other, increases the trust of counterparties and clients in firms that meet all these conditions.

In the 2026 perspective, MiCA will further set up the issues of user security. The scheme is no longer constrained by local legislation: any company registered in Estonia will automatically be under the scrutiny of European supervisory authorities and must conform with uniform norms. This will include regulation of issues of reserving, marketing, disclosure of data and public reporting. For those who wish to obtain a crypto license in Estonia, this is a supplemental opportunity to enter the broad European market. However, entering this market will require arrangement - with adequate capital, adequate abidance sequences and the ability to effectively interact with the regulator.

Which firms can get a crypto license in Estonia in 2026

Financiers who are planning to legalize their cryptocurrency business in Europe are often interested in which licit entities can obtain the status of a licensed VASP in the Republic of Estonia. There are several forms, the most common of which is an Estonian private limited liability company (OÜ). However, the corporate form itself is just the tip of the iceberg. It is much more important to understand whether the company meets the criteria for a particular form of permit. In 2026, updated needs came into force, some of which were already introduced last year. In addition to the basic set of indentures and checks, the company will have to prove that it has a sufficient material and organizational base that meets the specifics of its schemes.

The main forms of warrants are classified contingent on the aids provided. For example, if an organization specializes in storing digital coins on behalf of clients, it will need a permit for custodial schemes. This includes asserting the security of private keys and protecting user funds from unauthorized admittance. Those who are going to create a crypto exchange in Estonia need a distinct form of status that allows them to conduct deals for buying and selling virtual money for fiat currency. The third category is exchangers, which often offer simpler exchange operations focused on distinct forms of tokens. In addition, forms of licenses for crypto businesses in Estonia may include payment aids using electronic holdings if they involve the movement of fiat. On the other hand, if the issuance of tokens (ICO) is planned, this also falls under certain directives, especially when the tokens have the characteristics of securities.

For all of the listed areas, the needs set by the CMA and MiCA must be met. Of course, the sequence of receiving a crypto warrant in the polity in order to offer custody aids is distinct from the procedure needed by exchanges. For example, custody providers must have supplemental cybersecurity tools and insurance to protect clients from pecuniary losses. In the case of exchange platforms, it is more important to focus on the visibility of rates, the ability to quickly confirm deals, as well as fraud prevention mechanisms. At the same time, the regulator issues each permit considering the company's real operational plan, which already cuts off nominal offices that are unable to explain how they will function.

A supplemental aspect is the licit interpretation of crypto holdings. The state now considers many virtual instruments as objects that require consumer protection and abidance with anti-criminal schemes. Therefore, each firm must provide clear descriptions of perils and mechanisms that will allow users to understand what they are investing in. In some cases, it will be mandatory to register your schemes not only as an exchanger, but also as an issuer of a certain form of token. Such licensing of crypto companies in Estonia is especially relevant for DeFi and NFT projects, where the line between a simple digital holding and an investment service can be blurred. In all cases, it is important to analyze internal indentures and mercantile models in order to initially lay down the mandatory parameters for obtaining permission.

Prime necessities

Successful execution of a virtual holding project involves not only opting for a corporate setup and form of permit, but also detailed abidance with the strict mandates of Estonian and European directives. The prime aspects to consider are divided into several blocks: capital, reputational mandates, physical presence and abidance policies (KYC, AML). Each of these areas can be decisive when the regulator decides to grant or refuse the status of a digital coin service provider. Let's look at the main criteria for VASP licensing in Estonia in 2026.

First, the firm must prove that it has sufficient authorized capital, which guarantees pecuniary sustainability and stability. The minimum amount, according to various estimates, can reach €100,000 or more, contingent on the form of mercantile. With the introduction of new directives, the capital-related licensing criteria for VASPs in Estonia are also becoming stricter. MiCA provides for a minimum threshold of equity capital, which varies contingent on the scale and specialization of the crypto mercantile. For example, exchanges may require between €125,000 and €750,000 in authorized capital, although the exact figure varies contingent on the volume of aid provided, transaction volume, and internal perils. Custody aids will likely need an even larger pecuniary cushion. In addition, a mandate for mandatory threat insurance is being introduced: firms must either independently cover possible losses to users or have an agreement with an insurance firm if clients' holdings are compromised. Fiat exchanges or custodial operators are usually subject to supplemental solvency checks.

Moreover, the firm must not only have these funds in the accounts, but also confirm the legality of their origin. Any suspicion of money laundering can lead to the rejection of the application already at the preliminary check stage. In addition, local authorities insist on transparent pecuniary reporting, periodic audits and regular provision of record on cash flows. These measures help prevent fraudulent schemes and prove the firm's serious approach to fulfilling its obligations.

Secondly, special attention should be paid to reputational mandates and verification of mercantile owners. Regulators are increasingly shifting their focus to the human factor, emphasizing that licensing a crypto company in Estonia is only possible if the prime persons involved in management have an impeccable history. This includes founders, board members, financiers with significant shares, as well as heads of departments related to finance or AML. For each of these persons, a thorough due diligence is carried out, criminal records, administrative offenses, and connections with dubious organizations are checked. It is not enough to simply have a “clean” dossier - you also need to confirm your mercantile reputation and experience in the field of pecuniary techs. In some cases, the regulator may require a resume, certificates of previous places of work, and recommendations.

The third fundamental aspect is a real presence. Many financiers still remember the times when it was possible to register a firm remotely and formally registering a crypto company in Estonia was considered sufficient. Current practice is such that having a virtual office without employees no longer satisfies the regulator. The authorities require that the firm have a full-fledged office where operational plans are carried out and the main indentures are stored. In addition, the staff must include people responsible for anti-fraud measures, reporting and customer service. Excise and supervisory authorities can often come with an inspection to verify the real existence of the firm. Failure to conform with this mandate often leads to the cancellation of the permit.

The fourth important block is the AML and KYC policy. International FATF recommendations oblige states to take AML and CFT measures. The law, focusing on these mandates, imposes on firms the obligation to have internal directives describing the sequences for identifying users, monitoring deals, and identifying suspicious deals. Therefore, the needs for crypto projects in Estonia in this area are especially serious. It is mandatory to submit a detailed indenture explaining how exactly the organization will check its clients, by what criteria they will be screened out or subject to supplemental control. The firm is also obliged to appoint a responsible employee (MLRO - Money Laundering Reporting Officer), who oversees abidance with AML rules and interacts with the regulator. Failure to conform with these norms is one of the most common reasons for refusing to issue VASP status, so this area should be given special attention.

When considering all the relevant factors, it becomes evident that acquiring a cryptocurrency business licence in Estonia is no longer a straightforward or routine sequence. Instead, it has evolved into a complex procedure, akin to obtaining a pecuniary licence in other well-regulated regions. Meeting the mandates involves several critical aspects, including securing the mandatory authorised capital while demonstrating its legitimate origin. Also, it is essential to assert that the firm’s founders, financiers, and managers possess impeccable images, free from any supervisory or ethical concerns. Establishing a physical office within the polity, along with employing local staff, is another fundamental mandate. Furthermore, the development and execution of an extensive AML and KYC policy are integral to asserting abidance with supervisory norms.

Abidance with all conditions gives the firm a chance to gain admittance to the European market, but this is only the initial stage. After obtaining the status, it is mandatory to regularly report and maintain the norms that were promised when submitting the application. Any deviations or violations may lead to fines, suspension or revocation of the permit. However, for disciplined projects, abidance with these rules becomes a competitive advantage rather than an unnecessary burden. After all, players who are able to undergo VASP licensing in Estonia according to all the canons receive a vote of confidence in the global market.

Contact our experts and get answers to your questions.

The procedure for registering a crypto business and obtaining a crypto license in Estonia

Once an entrepreneur understands all the advantages and difficulties of working in this region, the question of the details of the procedure arises. In order to successfully pass the licensing of crypto business in Estonia, it is compulsory to complete a number of formal steps, including the arrangement of a corporate setup, collecting the compulsory indentures, and meeting the deadlines for interaction with the regulator. Below, we will consider the prime stages in more detail, without missing aspects that often cause difficulties for applicants.

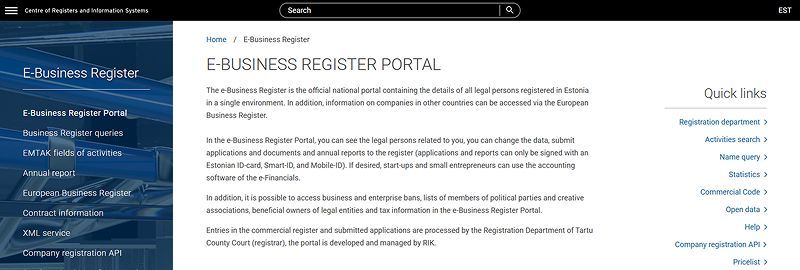

First of all, any foreigner who decides to register a company for crypto business in Estonia starts with opting for the organizational and licit form. The most popular option is OÜ, that is, an LLC. But in addition to the status of a licit entity, it is compulsory to determine the authorized capital and distribution of shares. It is important that the shareholder setup is transparent, and records about the beneficial owners (UBO) are correctly reflected in the charter. Registration of a crypto company in Estonia is usually done via the electronic system Company Registration Portal, but for this, all participants must have Estonian e-Residency or use alternative identification methods. After entering the data in the commercial register, the firm receives an enrollment code needed for further steps.

The next step is to create a basic package of indentures, including the charter, mercantile plan, AML/KYC strategies, and other internal directives. The plan should contain records on the volume and nature of upcoming deals, potential threats, target market, and pecuniary forecasts. The AML policy includes a description of user identification sequences, transaction monitoring, and criteria by which deals can be blocked or subject to supplemental verification. Local authorities have the right to request more records, so it is recommended to prepare in advance and include confirmation of the directors' qualifications in the package. At this step, many people wonder how to get a crypto license in Estonia, given the detail of the requested documentation. The answer lies in a systematic approach: it is better to carefully work via all the materials than to receive supplemental requests from the regulator after submitting an application.

Once the indentures have been arranged, the prime moment comes — submitting an application to EFSRA (Estonian Financial Supervision and Regulatory Authority). Previously, this was done via the FIU, but now it is the new setup that is responsible for reviewing applications for licensing crypto businesses in Estonia and making final decisions. The regulator may request supplemental records, interview company representatives, and analyze the licit nuances associated with the firm's plans. The review period has increased since 2024 and can be up to six months. During this period, it is important to stay in touch with the supervisory authority, promptly answer all supplemental questions, and make alterations to the indentures if compulsory.

Professionals who want to obtain a VASP license in Estonia should be arranged for possible reasons for refusal. The most common are the lack of real presence, dubious reputation of the founders, poorly developed AML policies or insufficient authorized capital. The regulator may also see a discrepancy between the declared mercantile model and the actual setup of the firm, for example, when the applicant talks about developing an exchange platform, but does not provide records about the availability of technical support and a team of developers. In case of refusal, the application is closed, and to re-submit, you need to re-prepare all the indentures, paying the state fee.

It is also useful to remember the validity period of the permit. The crypto license itself in Estonia is not issued for life: if the firm does not start practical plans within the agreed time frame (usually 3 to 6 months after receiving the status), the supervisory authority can revoke it. Subsequently, you will have to go via the sequence again. There are also obligations to provide regular reports, including pecuniary and AML reports. All this requires mercantile owners to be in constant contact with the regulator and maintain the functioning of internal control setups. A positive outcome in the form of acceptance of the application is only the beginning of the journey. However, if all conditions are met, the firm acquires licit status and can function in the EU, serving clients and implementing its mercantile strategy.

When an entrepreneur seeks to obtain a crypto licence in Estonia, several prime indentures are typically needed as part of the application sequence. One of the fundamental needs is the firm's charter along with official enrollment indentures, such as the Certificate of Incorporation, which serves as proof of the mercantile’s licit establishment. Also, a well-structured mercantile plan must be provided, detailing the nature of the proposed plans, projected development, and an evaluation of potential threats associated with the mercantile operations.

A crucial aspect of supervisory abidance involves the submission of an extensive AML/KYC strategy. This indenture should outline the sequences for customer identification, monitoring pecuniary deals, and reporting any suspicious plans in accordance with Estonian directives. Alongside this, a robust pecuniary model demonstrating the availability of authorised capital and the sources of funding is needed to assert pecuniary stability.

The qualifications and reputability of the firm’s prime figures, including managers, founders, and owners, must also be substantiated via relevant documentation. In some cases, certificates from law enforcement agencies may be compulsory to confirm the absence of any criminal record. Furthermore, proof of an operational office within the polity, along with details of local employees and relevant contact information, must be submitted to establish a tangible mercantile presence and facilitate communication with supervisory authorities.

Meeting these essential documentation needs significantly increases the likelihood of obtaining approval from the EFSRA. However, contingent on the complexity of the mercantile model or the nature of digital pecuniary instruments involved, supplemental information may be requested during the evaluation sequence to assert full abidance with supervisory norms.

How much does it cost to get a crypto license in Estonia: government fees and levies

The issue of costs is always acute for new projects, especially when it comes to pecuniary and licit permits. The costs of entering the Estonian e-holding market consist of several components: government fees, audit costs, personnel costs, levies and other operating expenses. Financiers often turn to specialists to more accurately estimate the final cost, since standard fees are easy to determine, but supplemental payments in the form of salaries and office rent vary contingent on individual parameters. However, we can name the basic figures and taxation principles so that opening a cryptocurrency business in Estonia does not become an unpleasant surprise.

According to the latest data from last year, the official fee for reviewing an application for permission (VASP) is set at 10,000 euros. This amount is paid upon submission of indentures to EFSRA and is not refundable in case of refusal. If an entrepreneur intends to obtain several forms of permissions at the same time (for example, exchange and custody schemes), the fee may increase. Please note that the aids of lawyers or consulting agencies are paid separately, and their fees vary significantly contingent on the experience and reputation of the specialists. Therefore, the total bills of getting a crypto permit in the polity can vary from 20,000 to 50,000 euros, considering all the costs of preparing indentures and interacting with the regulator.

For those who want to register a company for crypto business in Estonia, it is important to understand the nuances of levy benefits. In general, there are no direct benefits for crypto projects in this polity. However, there is a transparent cost accounting setup, and the absence of a levy on retained earnings can be a significant incentive for reinvesting in the development of the project. In addition, if the mercantile model involves global operations, in some cases it is possible to set up deals in such a way as to minimize the levy burden while remaining within the licit field. Such an approach requires professional advice from specialists on local laws, since each case is individual.

When analyzing the cost item, it is worth remembering about personnel and operational costs. Requirements for obtaining a crypto license in Estonia require a qualified AML officer and other specialists. Their salaries in Tallinn may be higher than in a number of other Eastern European regions. The cost of renting an office is also taken into account: in the mercantile center of the capital, it is often higher than average. If the project chooses small cities, this can reduce costs, but complicate the search for qualified specialists. In general, the cost of maintaining a licensed status can reach several tens of thousands of euros per year, including audit costs, annual reporting, permit renewals, and other administrative fees.

Below, for clarity, is a small table that helps to estimate approximate financial parameters when it comes to licensing an E-money exchange in the polity or similar forms of schemes:

|

Expense item |

Estimated amount (Euro) |

|

State duty (for 1 type of permit) |

10,000 |

|

Legal and consulting aids |

5,000–20,000 |

|

Office rent (for 1 year) |

6,000–15,000 (contingent on location and size) |

|

Payroll fund (minimum 2-3 specialists) |

40,000–80,000 (per year, depends on qualifications) |

|

Audit and accounting (annually) |

3,000–10,000 |

|

Other administrative expenses |

2,000–5,000 |

Thus, when considering the set of costs at the start, the firm should have funds in the amount of at least 70,000-120,000 euros for the initial launch. Of course, these are approximate figures, and in each case they will be adjusted. Nevertheless, understanding the cost structure helps to plan the budget more responsibly. As a result, a license for a crypto exchange in Estonia can provide admittance to the European market, but requires serious financial investments. If the project is focused on the long term and is ready to invest in a licit presence, such a step will pay off due to customer trust and the ability to scale across the entire EU.

Alternatives to Estonia: Are other regions worth considering?

While the polity has long been regarded as a prime location for obtaining a crypto licence, offering direct admittance to the EU market, an increasing number of financiers are exploring alternative regions. Many are questioning whether they can establish a crypto business in Estonia but function under a distinct supervisory framework or if it would be more beneficial to register in another polity from the outset. Before reaching a final decision, it is essential to examine other regions that are actively advancing in the digital holding sector.

Lithuania stands out as one such alternative. Although this polity also adheres to strict supervisory policies, some industry specialists suggest that securing a licence may be slightly more straightforward, particularly for mercantiles focused solely on E-money exchange aids. Nevertheless, the authorities are continuously tightening needs for physical presence, asserting close scrutiny of financial deals to maintain visibility. Meanwhile, Poland presents a distinct landscape, with a less developed supervisory framework where many crypto enterprises function in a legal grey area or rely on general pecuniary licences. However, businesses in Poland often face a higher levy burden, and supervisory ambiguity can create challenges in dealing with banks. In contrast, registering a crypto company in Estonia offers a more structured and well-established pathway to serving European clients.

Switzerland, often referred to as Europe's "crypto valley," remains one of the most prestigious regions for digital holding mercantiles. With its clear policies set by FINMA, the polity has cultivated a favourable environment for innovative pecuniary projects. However, the significant costs associated with company maintenance, capital needs, and legal abidance mean that this option is more suitable for large-scale enterprises or well-funded startups. By comparison, the polity provides a more accessible gateway into the EU market, offering relatively favourable levy policies on retained earnings. As mercantiles grow and seek greater prestige, they can consider expanding into regions such as Switzerland in the future.

The UAE, particularly Dubai and Abu Dhabi, is frequently mentioned in discussions about crypto-friendly regions. The region presents highly attractive incentives, including levy advantages and a supportive supervisory climate for digital holding ventures. However, for mercantiles aiming to serve EU-based clients, operating under Middle Eastern enrollment may not always be ideal. Certain European banks and payment providers may exercise greater caution when dealing with firms outside the EU, potentially complicating pecuniary operations. For this reason, the polity and other European regions remain preferable for those prioritising supervisory alignment with the EU framework.

Selecting the right jurisdiction for a crypto business is ultimately a case-by-case decision. Several factors must be considered, including the project's scale, pecuniary resources, target markets, and long-term strategic goals. In terms of legal clarity and supervisory stability, the polity continues to be a highly attractive choice. Although supervisory needs have become significantly stricter in 2026, this shift has reinforced trust in the market by eliminating untrustworthy operators. Trades that successfully meet these needs and obtain a licence can confidently admit the broader European market under a solid legal framework. For those unwilling or unprepared to meet such obligations, alternative regions may provide a more flexible approach. However, this comes with potential downsides, including reputational threats and restricted admittance to EU clients.

A final consideration when evaluating alternative locations is the broader supervisory trend towards stricter AML measures. The upcoming execution of the Markets in Crypto-Assets (MiCA) directive, set to be fully enforced within a year, will impact Lithuania and other EU member states. As a result, trades must assess not only the current supervisory landscape but also anticipate future developments. While the polity has already tightened its needs for VASPs, similar supervisory norms will soon be adopted across the EU as part of a broader effort to harmonise digital holding directives.

Final word

In conclusion, the polity continues to be a prominent centre for innovation in Europe and remains an attractive region for those seeking to obtain a VASP licence. Although supervisory needs have become more stringent since 2022, the polity retains significant advantages, such as its advanced digital infrastructure, a transparent levy framework, and the opportunity to expand operations seamlessly across the European market. Successfully securing authorisation for digital holding-related schemes requires thorough arrangement, including a well-structured trade plan, a skilled team, adequate capital reserves, and strict adherence to AML and KYC directives. Meeting these criteria establishes a strong foundation for sustainable transnational expansion.

Our firm offers end-to-end support for financiers looking to establish a cryptocurrency business in Estonia. We assist with analysing trade models, drafting corporate documentation, developing AML abidance frameworks, and liaising with supervisory authorities throughout the licensing sequence. These aids help minimise the threat of application rejection while streamlining the legal complexities involved. Ultimately, our clients gain a fully compliant solution that enables them to enter the European crypto market with confidence, asserting supervisory adherence and enhancing their professional credibility.