Getting a license for a physical currency exchange office in the Czech Republic, or more accurately authorization from the Central Bank, is one of the primary methods that business visionaries wishing to give cash trade administrations in this nation must experience. Numerous outside financial specialists pay attention to this ward owing to its steady fiscal circumstance, straightforwardness of bureau indices and favorable geographic premise. Tall concentration of visitor streams, as well as dynamic commerce ties with the EU nations, pull in agents of the mercantile community to the Czech Republic, who look to organize and create their claim ventures in the field of pecuniary administrations. The money trade commerce has continuously been at the crossing point of the interface of expansive fiscal specialists and ventures, since the stream of clients remains consistent: sightseers, cross-border specialists, outside understudies and basically individuals wishing to change stores at apt tariffs. Hence, the request for modern trade workplaces remains in a handful of states in the republic, contributing to the encouraging expanse of this fragment of the pecuniary mercantile.

In this distribution, we will take how to procure a formal warrant for currency exchange in the Czech Republic and examine the particular prerequisites that neighborhood controllers set for proprietors of unused mercantile workplaces. The peruser will discover a broad fabric covering the legitimate and pecuniary viewpoints of the concern: from the requisite to enlist a venture in this nation to conceivable challenges in scheming papers and conducting operational exercises. We will touch on the commonsense subtleties of picking a domain, connections with pecuniary, and the assess frame in impact in 2026. This write can be a valuable source of data for business people looking to grow their nearness in the European wherewithal likened showcase or discover a dependable stage for beginning a mercantile in the premise of cash trade.

What is a license for a physical currency exchange office in the Czech Republic and why is it needed?

Propelling a remote transpose undertaking in the Czech Republic is not basically a procedural step, but a completely commanded and fundamental lawful necessity. A formal file from state specialists asserts that an authorized money trade substance works in full understanding with national laws and pecuniary advertisement directions. For venture people, securing such authorisation gives a dependable lawful premise for executing trade exchanges including different monetary forms in a statute and organized manner.

It is imperative to procure it that procuring consent from the Czech National Bank goes distant past getting a schedule certificate. It underscores the straightforwardness and legit soundness of the task, ingrains more noteworthy certainty among clients, commerce accomplices, and regulators.

A physical currency exchange license stipulates the lawful privilege to execute pecuniary exchanges with people, corporate clientele, and other teachers requiring cash change administrations. These exercises are subjugated to rigid oversight, represented by keeping cash and money related enactment, and are adjusted with AML and CTF commitments. To maintain the country's standing as a reliable money related center, controllers altogether vet permit candidates, analyzing their notoriety, source of pool, and other basic markers of operational integrity.

Establishing a physical trade outlet in the Czech Republic obliges trade proprietors to familiarize themselves with territorial monetary guidelines and practice. An authorized office not as it were garners proficient validity but moreover opens the potential to extend administrations, such as joining installment terminals and connecting with universal installment stages. Conducting such exercises without legitimate authorisation uncovered businesses to lawful punishments, counting fines, account suspensions, or indeed criminal risk. In this manner, judicious business people frequently secure official acknowledgment in progress, regularly enrolling the offer assistance of experienced lawful consultants.

A similarly vital perspective is the creation of strong inner arrangements to oversee client connections and defend money related streams. Long-term practicality and administrative compliance can as it were to be accomplished when all required conditions are satisfied. Moreover, existing enactment forces continuous commitments on authorized administrators to keep up precise records and routinely report to supervisory bodies.

Failing to get an appropriate permit can lead to serious lawful results. The state considers unlicensed operations a genuine infringement of monetary controls, possibly coming about in strong sanctions and criminal procedures. Such infractions can essentially harm a company's development prospects and discolor the commerce owner’s proficient notoriety.

Why is the Czech Republic a profitable jurisdiction for foreign exchange business?

The Czech Republic has long been popular for its steady and open monetary frame. Formal direction of this segment was presented back in the 1990s, when the nation started dynamic integration into the European financial space. Since at that point, the legitimate system and supervisory capacities have advanced, based on European mandates and neighborhood directions. There are many tools available to advanced supervisory specialists that allow them to intervene in pecuniary education exercises, prevent illegal exchanges, and guarantee buyer interface. In the Czech Republic, transnational tycoons desiring to construct a land-related transnational exchange office note the openness of controllers: the National Bank pursues to encourage the amplification of free competition and immediately replies to enquiries.

The polity offers apt requisites for commerce individuals. Firstly, charge collection in the commonwealth remains one of the most undaunted in Central Europe, especially in comparison with a few neighboring polities. Besides, governmental relentlessness invigorates the passage of unused examiners and the course of action of an obvious transpose ambience. For those organizing to warrant the exercises of a transpose office in the Czech Republic, not as it were the examine burden is basic, but additionally the in common quality of the blueprint: the closeness of branches of widespread monetary, favorable goals for coordinations and a tall degree of digitization of bureau methodologies. All these factors contribute to the actuality that the handle of paving advanced transpose laboring ambiences is not taken after overcoming bureaucratic barriers.

Another basic point is direct and clear interaction with bureau masters. Commerce individuals wishing to permit a trade office in the Czech Republic can depend on clear rules with edification disseminated by the National Bank and some competent instructors. In extension, enrollment techniques habitually take less time than in other Eastern European districts. Having successfully passed all affirmation stages, a businessman gets the chance to legally grant clientele with a degree of organizations centered on the transpose of exterior wherewithal likened shapes. Such openness of the controller draws in various small with medium-category venture to the polity that are arranged to labor simultaneously to clear rules and enter the promising wherewithal compared mercantiles of the EU.

When choosing an area for an exchange office in the Czech Republic, speculators with experts as a rule pay consideration to huge cities - Prague, Brno, Ostrava, as well as well known traveler areas. This is where the stream of potential clientele is most articulated: visitors, remote understudies, foreigners and commerce travelers of worldwide companies. Of course, in these cities there is competition from existing workplaces, but a shrewd choice of premise (for illustration, close preparation stations, airplane terminals or shopping centers) can guarantee a steady convergence of clientele. In expansion, the Czech Republic is effectively advancing itself as a traveler center of Europe, which implies steady interest in the administrations of trade workplaces for individuals arriving from nations with other currencies.

To affirm the developing showcase for trade administrations, it is sufficient to see at the insights of the monetary division in later a long time. Agreeing to official measurements, the volume of change exchanges expanded by 7% in the final year. Specialists anticipate encouraging development of 5-6% yearly until 2026. The add up to turnover of the showcase may surpass 8.2 billion euros if favorable patterns in tourism and trade movement proceed. All this proposes that lawfully opening a physical currency exchange office in the Czech Republic is a promising trade thought that can give a steady cash stream and benefit. There is competition in this showcase, but with the right technique and compliance with all legitimate directions, financial specialists can check on a strong put in this industry, particularly if they offer clientele a helpful area, comfortable conditions and alluring rates.

Regulation of exchange offices in the Czech Republic

In the Czech Republic, the control of pecuniary exchanges is guided by a comprehensive lawful system composed of different laws, controls, and official rules. Business visionaries arranging to pioneer a physical money trade office must to begin with and end up recognizable with the core administrative rebel that will oversee their operations. Chief among these is the Act on Trade Exercises (Zákon o směnárenské činnosti), which stipulates the legitimate establishment for wherewithal transposing, traces authorizing methods, and sets benchmarks to diminish the dangers of non-compliance.

Prospective commerce proprietors must consider other significant laws, such as the Act on AML and the Czech Respectful Code (Občanský zákoník), both of which address key issues like the authenticity of pool and participation with money related administrative bodies.

A key component of running a wherewithal transpose base includes executing strict strategies for controlling cash streams, confirming client personalities, keeping up legitimate bookkeeping records, and putting away basic documentation. Each exchange must be conducted with total straightforwardness, whereas effectively working to avoid unlawful exercises such as cash washing and psychological militant financing. Disappointment to conform may result in administrative sanctions, counting solidified bank accounts and formal investigations.

Submitting a requisition for a permit to the Czech National Bank (ČNB) is a well-defined handle. It requires precise documentation and adherence to the required strategies. Taking after a point by point assessment, the ČNB will either favor or deny the task. The authorizing handle too incorporates arrangements for overhauling lawful data, altering the scope of operations, and enrolling modern department areas. All such alterations must be settled inside a formal lawful setting, guaranteeing clarity and legitimacy.

Czech money trade directions are frequently reexamined to adjust with advancing European Union mandates. As a result, commerce proprietors must stay mindful of both national prerequisites and broader EU money related compliance benchmarks. Those who take after the rules closely and plan their records with care can ordinarily secure a permit inside a few months.

Importantly, the Czech administrative frame is not designed to discourage enterprise, but or maybe to shield the pecuniary sector's astuteness. When lawful instabilities occur, venture visionaries are enabled to counsel with competent advisors or the main offices of the Czech National Bank. This cooperative interaction between state educators and commerce administrators contributes to the expanse of a safe and attractive ambience for modern money-related functions.

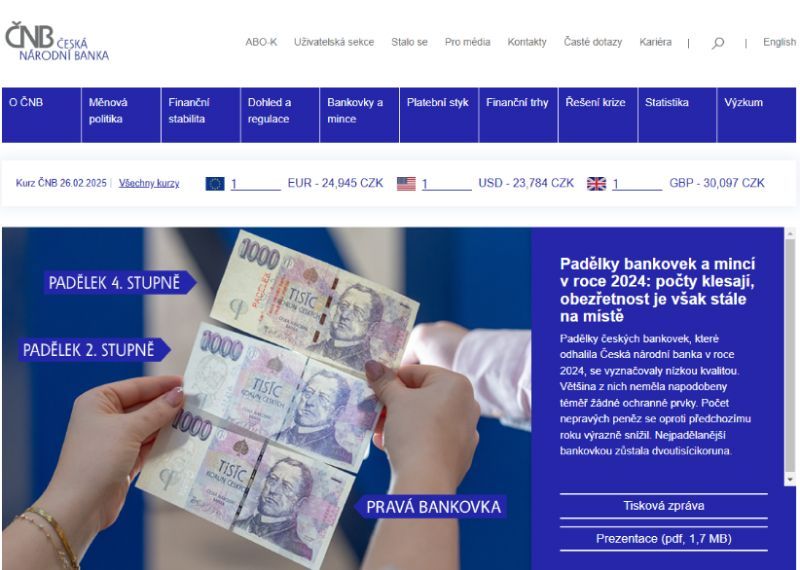

The task of ČNB in procuring a currency exchange license in the Czech Republic

The Czech national fiscal institution (Česká národní banka, ČNB), which unifies the bureau frame and enforces adherence to it, plays a crucial task in handling the cash linked presentation. It should be visited by venture tycoon scheming to procure a warrant for similarly transformative trades in the Czech Republic. This framework will not essentially provide an authorisation so as to control how the licensee conforms with the indices for anticipating coin washing, file maintenance, putting forward, and multifarious facets of pecuniary development. The CNB acts as a strict regulator but also provides guidance and support, which distinguishes itself from private enterprise visionaries navigating the complex statute ambience.

Bank regulators thoroughly test the software assessment process, seeking at the pioneers' fame, the investment resources, the alternate stratagem, and the exact tool of the potential swapping office. The purpose of this examination is to make sure that the person requesting permission to operate a physical cash trading venture in the Czech Republic can guarantee the guard and aptness of financial transposes while also adhering to all necessary regulations, including AML standards. If the candidate meets all requirements, he receives a comparing authorisation, which certifies the statute performance of transpose sports overall.

The desire to found a physical money trade point in the Czech Republic anticipates that the venture will be linked with the Central Bank not as it were when submitting a requisition, but in addition on a ceaseless preface. The bank has the right to conduct arranged and unscheduled evaluations of the exchange office, watching the rightness of cash trades, compliance with client recognizing verification rules and pecuniary checking rules. If encroachments are recognized, orders may be issued to slaughter them or, in more honest to goodness cases, sanctions may be constrained up to and tallying suspension of the allow. Such close thought to exchange work ambiences is clarified by the prerequisite to keep up a tall degree of conviction in the country's cash related instruction and ensure the guard of all grandstand participants.

Registration and getting assent from the Central Bank allow you to enlist a cash trade office in the Czech Republic in official registers and consolidate it in the list of organizations authorized to warrant critical organizations. This infers that the exchanger is guaranteed by bureau and statute resistance, and clientele can certainly utilize its organizations without fear of encountering wrong blueprints. Getting to the bureau frame and unfaltering communication with the controller provide back to commerce individuals in things of each day operational works out: whether it is updating interior enlightening or displaying cutting edge propels to guarantee saves and personal data of clients.

Business visionaries who have directed authorization from the Czech National Bank get a competitive advantage in the diagram of formal position and stated validity. This makes a difference to create conviction among clients and collaborators, as it consents that the trade has passed strict state control. In the long term, interaction with the Czech National Bank turns out to be the most basic figure in the unfaltering improvement of the venture, since compliance with all bureau benchmarks reduces the peril of sanctions and adds the commitment of banks and other cash related instruction with which the trade office organizes. With the adjusted organization of trade shapes and keeping up coordinate relations with the commander, the proprietor of the trade office can tally on money related progression and keep up a magnificent commerce notoriety.

Conditions for issuing a permit for a physical currency exchange office in the Czech Republic

Every person or association that needs to conduct cash alter works out must follow the built up methods; disappointment to do so renders getting authorisation for wherewithal transpose functions in the polity inconceivable. To begin with and preeminent, it is imperative to enlist in a true blue substance so as to comprehend the prerequisites of Czech enactment. Basically, the foundation of a joint-stock company (as) or a limited liability company (sro) is frequently favored as these lawful shapes offer adaptable openings for capital courses of action and pulling in creators or investors.

The reputation of the company's originators and organization is as well carefully checked, as insight is incredibly basic in this zone. Individuals with uncommon sentiments for pecuniary infringement or those included in flawed trades may go up against a refusal to issue a license.

Particular thought is paid to the Know Your Client (KYC) component and anti-money laundering (AML). Government workplaces seek to square any conceivable ways to back illegal works out, and in this way strict control over cash related trades is mandatory. A future exchange director must make and actualize an interior AML course of action, which shows the stratagem for recognizing clientele, trade limits, the specifying stratagem to commanders, and the edicts of scheme when suspicious trades are distinguished. Without this, it is unfathomable to secure assent to labor in the money related sector.

Players who truly expected to work directly and authentically are permitted to operate a physical money exchange office in the Czech Republic, as permitted by such point-by-point regulations. However, the essentials should not be viewed as unimportant bureaucracy. This tool is intended to guard the state, purchasers, and fiscal masters against potential fraudulent schemes. One of the main tenets around which the Czech Republic's fiscal strategy is built is cash-related strength and transparency. Companies who disregard these rules run the risk of losing bank support or, more likely, having their allowances revoked and their accounts blocked.

Last but not least, setting up a physical trading office in the Czech Republic is a fundamental step, within which it is essential to confirm adherence to certain regulations and requirements for the cash zone's operations. The trade person must provide video perception and caution methods, guarantee cash security procedures, and build a workforce that understands the pecuniary organisations' particular. Distinct records and certificates that are provided with the warrant requisition attest to all of this. After successfully completing all the imperative arrangements, the entrant is capable to effectively promote the creation of currency transpose organisations in the republic and its ongoing benefits.

Contact our experts and get answers to your questions.

Step-by-step instructions: how to procure a currency exchange license in the Czech Republic

Venture determination and preference of possession. To procure a warrant for a physical cash exchange office in the Czech Republic, the future proprietor ought to start with to select the true foundation in which the venture will work. Most continually, they select limited liability companies (sro), less routinely - joint-stock companies (as). After picking the diagram of proprietorship, it is imperative to arrange the component files and abandon an inquiry for enrollment in the Commercial Enroll. At this organization, concerns affiliated to the dispersal of offers between the makers, the course of task of the leading body and the course of task of bosses cautious for operational works out are as well settled. If essential, you can contact attorneys or counseling working ambiences with affiliations working with outside cash related aces. This step ensures the validity of the endeavor and renders the introduction for consequent methodologies when procuring a warrant for a physical cash exchange office in the Czech Republic.

Course of task of statutory reports. The miniature organization consolidates finalizing and favoring statutory records that reflect all key focuses of the company's works. Each clause must conform with the legitimate benchmarks of the republic, something else, when investigating the records, the controller may require changes. Besides, the exchange person ought to think over a trade that will connect an examination of the target gathering of people, a course of activity of progressing works out and enhancement prospects. Competent recording of statutory reports makes a difference to keep up an imperative isolated from different issues when submitting a requisition to the National Bank.

Orchestrating and submitting a requisition to ČNB. At this course of activity, you are imperative to abandon a requisition for authorisation from the Czech National Bank. The bundle more routinely than not solidifies corroboration of joining of the meander, statutory records, rent assentions for the premises for the trade office, a point by point trade course of task with AML/KYC course of activity. Specific thought ought to be reimbursed to attest the origins of the root of wherewithal, the notoriety of the organization and the common straightforwardness of the mercantile synopsis. The requisition is stipulated in the bolstered layout via the ČNB electronic frame or points to the chancery. At that point the survey handle starts, in the middle of which the controller can send clarifying requests.

Getting an allowance and selecting a cash trade point. If the inspection is compelling, the company gets the long-awaited allow to permit for a physical cash exchange point in the Czech Republic. Contingent on the gotten report, the trade is enrolled in the enroll and is permitted to begin working. It is imperative to keep in mind that the permit may have restrictions on the volume of exchanges and the sorts of monetary benchmarks that are permitted to work. It is as well vital to keep up contact with the controller, send standard reports and, if basic, overhaul company information. All neighborhood headings must be taken after to keep up a crucial partitioned from authoritative measures or disavowal of the warrant.

What documents are required to procure a license for a physical exchange office in the Czech Republic

A critical parcel of the duration when securing an exchange office is spent collecting and fixing files. The Czech National Bank carefully analyzes the shown bundle: it considers approximately information around the company, shareholders, organization, and moreover checks pecuniary ensures and compliance with AML edicts. The proprietor of the future exchange should approach this course of action with the most extraordinary commitment, since any botch or non-compliance with formal requisites can prompt impedes or undoubtedly veto to hand a warrant.

Below is an induced numeration of the essential papers that an entrant will require to encounter sanctioning of a cash trade office in the Czech Republic and get the entitlement to execute venture:

- Module files of the venture (structure, take note of association).

- Extract from the Trade Enroll (certification of enrollment of a true blue frame).

- A transpose orchestrated with nitty dirty calculations of future operations volumes, advancing procedure and pecuniary forecasts.

- Lease understanding for premises for an exchange office or reports consenting proprietorship of the property.

- Confirmation of origins of wherewithal (bank verbalizations, survey reports, etc.).

- Developed internal AML and KYC courses of action, checking a delineation of clientele recognizing confirmation and specifying procedures.

- Indentures of no criminal record for key creators and chiefs, as well as assertion of their commerce reputation.

- Additional records at the inquiry of the controller (confirmation of staff capabilities, specialized delineations of cash equipment, etc).

After this bundle is formed and checked by lawyers, the handle of recording a requisition for sanctioning a cash trade office in the Czech Republic begins: the entirety is sent to the Czech National Bank. At the study orchestrate, the Central Bank may inquire additional indentures or clarifications on any centers. That is why it is worth it to begin with drawing closer the assembly of papers as carefully as conceivable. Upon completion of the examination, the controller makes a choice: issues a allow or denies, communicating the reasons. In instances of refusal, the trade visionary has the chance to alter the insufficiencies and re-handing the chronicles, but this will take additional time and effort.

Collections for warranting a money trade office in the Czech Republic serve as a kind of "calling card" of the future commerce in the eyes of the inspection masters. A add up to an alter bundle not as it were streamlines the preparation of handing an allow, but in addendum renders a thought of the company's straightforwardness and unflinching calibre with the controller. It is crucial to get it that undoubtedly after tolerating authorization, the proprietors of the exchange office ought to continue to conduct commerce works out taking into consideration all built up measures and benchmarks. Standard declaring, capacity of fundamental reports and position for appraisals are a crucial parcel of the works out of authorized pecuniary organizations.

Founding a physical currency exchange office in the Czech Republic: key aspects after procuring permits

Once a trade visionary has gotten authorization to work a stationary money trade point in the Czech Republic, prospects for moving veritable operational work open up. In any instance, at this organization it is basic to keep in mind that in fact having gotten a formal position, the commerce remains under the close supervision of the controller. The proprietor is obliged to completely conform with the sanctioning with regard to financial control and fulfill the necessities for putting absent documentation. As it were if all conditions are met will theventure be able to labor reasonably and keep up a vital separate from penalties.

One of the start with assignments is to select a region where you orchestrate to enlist a cash trade office in the Czech Republic. It is judicious to analyze the degree of individual on foot and traveler movement, the closeness of rivalries and potential clients. From practice, it is known that it is most profitable to discover exchange working ambiences in places where people routinely require change organizations: plane terminals, tremendous get ready stations, true and exchange regions, shopping centers. At the same time, it is basic to take into consideration the taking a toll of rent and the necessities for specialized adaptation of the premises. The change of preference of region routinely gets to be an authoritative calculation in the triumph of the blueprint.

Handing a permit for a physical money trade office in the Czech Republic also suggests the prerequisite to take after the rules for planning the cash run. The room must be arranged with cash registers that conform with current controls, and information systems for checking current exchange rates must be given. In a few cases, commerce visionaries moreover get ready the office with video observation systems and cautions to anticipate potential infringement. In addition, all workforce must be arranged in AML and KYC benchmarks, be able to precisely recognize clientele and report suspicious transposes.

For those who have picked to open a physical trade office in the Czech Republic, it is additionally crucial to get it that advancing rebellious work to a few degree in an unforeseen way here than in retail or catering. Drawing in clientele can be based on giving favorable exchange rates, exceptional dedication programs for typical clientele and additional comforts (for outline, an electronic board with current rates, the capacity to make online reservations). The company's reputation plays a basic role, since various people incline toward exchange saves as of the presently known and illustrated center. Thus, extraordinary advantage, clear conditions and aware treatment of clientele are a prerequisite for productive work.

Tax regime for companies engaged in exchange transactions in the Czech Republic

In the setting of pecuniary exercises related to money trade, it is imperative for business people to get it which charges for an exchange office in the Czech Republic are in impact from 2026. The key financial installment is the corporate income tax (CIT, some of the time alluded to as CIT), which applies to all sorts of legitimate substances, counting branches of remote companies. Companies enlisted in the Czech Republic are considered charge inhabitants and pay this assess on their add up to pay earned around the world. Non-residents are at risk to pay CIT as it were on benefits that emerge in the region of the republic. In expansion, any frame of association with boundless risk (e.g. common associations) is saddled on benefits through the offers of such corporate accomplices, which ought to be taken into account when choosing an organizational structure.

As of 1 January 2024, the corporate pay assess rate for conventional companies has been expanded to 21% (already 19%). This also applies to companies that have as of now been approved by the Czech Central Bank and have started operations. This rate appertains to the whole sum of benefit, counting capital gains from the deal of offers, unless the salary from the deal of offers is excluded beneath extraordinary rules on charge motivating forces. For the period from 2023 to 2026, the nation has presented a “windfall salary tax” instrument, which is a 60% extra charge on wage charge. It influences the benefits of huge banks and vitality division companies. Overabundance benefit is characterized as the portion of the pay assess base that surpasses the normal for 2018–2021, expanded by another 20%. Subsequently, for the comparing share of the assessable base, the add up to rate in 2024 and 2026 may reach 81%, taking into account the standard assess (21%) and the extra additional charge (60%).

Another vital perspective is the rules for announcing and paying VAT. The VAT report is handed month to month or quarterly, contingent on the volume of exchanges and the status of the citizen, and must be handed no afterward than the 25th day of the month taking after the charge period. In parallel with the statement, the citizen is required to yield the so-called "control announcement", which reflects nitty gritty data on all issued and obtained solicitations. Based on this information, assess specialists can compare data on exchanges between counterparties and distinguish disparities. Disappointment to yield a control affirmation or blunders in filling it out regularly lead to fines. This is why some time recently opening a physical exchange office in the Czech Republic, it is imperative to think through not as it were the deals technique, but moreover the bookkeeping perspectives in arranging to dodge claims from monetary specialists.

What difficulties may arise when procuring a currency exchange license in the Czech Republic and how to avoid them

In show disdain toward the relative straightforwardness of the bureau system, getting a permit for a physical cash trade office in the Czech Republic can be met with distinctive inconveniences. The most common issue is a lacking understanding of Czech sanctioning, which leads to wrong printed fabric. Botches in documentation, the nonappearance of basic certificates or botches in money related figures - all this delays the allowing arrangement and can conclude up the reason for refusal.

Another potential issue is the strictness of AML necessities. A commerce visionary considering how to procure a physical currency exchange license in the Czech Republic should take care of a clear instrument for recognizing clients and certifying the legality of the starting of saves. The littlest gaps in making interior headings or dodging checking of flawed trades can lead to fines and blocking of accounts. As a result, owning an exchange office turns into an hazardous commerce if you do not pay due to combating cash washing. It is uncommonly basic to build a KYC course of action from the outstanding beginning, get ready staff and ensure the balanced capacity of all crucial reporting information.

Some companies go up against issues of interaction with banks. To get assent for a physical cash trade office in the Czech Republic, you require to open a corporate bank account in a neighborhood or around the world pecuniary institution. At the same time, banks are cautious when working with exchange work ambiences due to the tall threats related with conceivable back in shadow plans. If a commerce individual does not have a clear exchange course of action and does not have an flawless reputation, the bank may refuse to open an account or set strict advantage conditions. To lessen the likelihood of such a circumstance, you should get prepared, add up to information around the company and its originators in advance, and additionally outline to the bank your energy to conform with all pecuniary regulations.

Competition perils should not be checked down either. The choice to open a cash trade office in the Czech Republic in well known traveler ranges, such as the center of Prague, suggests that you have to compete with existing companies. If an exchange cannot offer favorable rates, additional organizations, or an accommodating region, it will be troublesome to draw in a basic client base. A few commerce individuals overestimate the publicized potential and stand up to a circumstance where working costs create faster than turnover. To keep up a vital part separate from such inconveniences, cautious exhibit examination, the choice of a curiously advantageous concept, and competent cash related organization are necessary.

It is basic to get it that all the over inconveniences should not stop theorists. It is exceptionally conceivable to secure a permit for a trade office in the Czech Republic without a doubt for a further company, if you act dependably and dependably. The key to triumph is a point by point consideration of bureau benchmarks, lucky arranging of correct reports and a direct approach to doing exchange. If questions rise or there is lacking data on a few points, it is way superior to contact specialized aces in advance - this will help save time, evade fines and keep up an exchange reputation. Inevitably, having overcome all obstructions, the commerce visionary picks up to get to a consistent and advantageous segment of the Czech pecuniary promotion.

Conclusion

In the finality of why apt reinforcements are so imperative when requisiting for a warrant for a physical money trade office in the Czech Republic, much is picked by true blue subtleties and a tall degree of obligation to the controller. A competent advisor will not as it were to offer to help a businessman collect the fundamental reports, but will as well build a stratagem for interaction with pecuniary, bureau workplaces and levy masters. In the instance of questionable circumstances, specialists are able to quickly curb issues, securing the recognition of the money related pro and the degree itself. Of course, qualified offer assistance increases the chances of a fast and productive result, and besides minimizes the threats of definitive fines or refusal to hand in a permit.

Our venture has a long duration of inclusion working with trade visionaries from assorted countries and knows how to procure a physical currency exchange license in the Czech Republic, taking into consideration all the highlights of neighborhood sanctioning and the present prerequisites of the Czech National Bank. We offer comprehensive offer assistance, from the preparation of statutory files to the organization of the operational work of a ready-made exchange office. Much obliged to set up contacts in the saving cash portion and significant data of statute nuances, we can basically speed up the planning and provide strong back at each organization. Such a comprehensive approach licenses our clients to enter the promising Czech exhibit without inconsequential brother and delays, arranged to offer relentless cash related openings and widespread affirmation.